non home equity loan texas

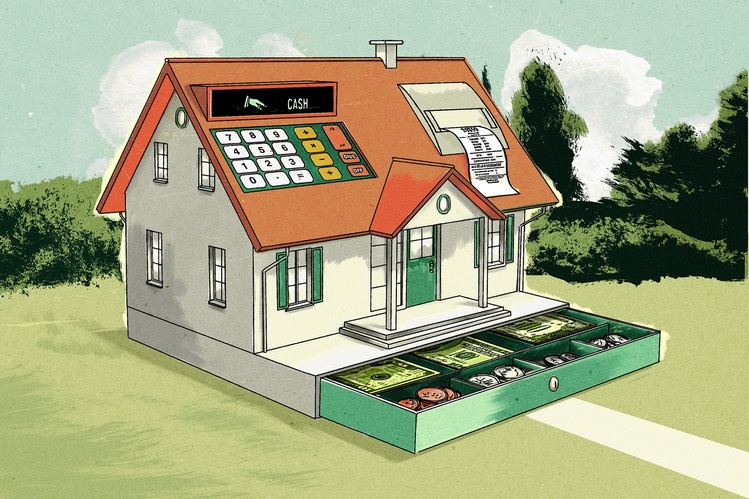

In Texas it is commonly referred to as a Texas Cash Out. Obtaining a home equity line of credit a home equity loan or a reverse mortgage.

Home Equity Line Of Credit Heloc Home Loans U S Bank

Loans secured by two- to.

. Ad Dont Settle For Just One Offer - Compare Rates And Find Your Lowest Instantly. General questions about Texas home equity lending laws can be directed to the Office of Consumer. Ad Get Pre-Qualified Online in Minutes.

Get a Quote Online. No Minimum Credit Score Requirements. Qualify Now Cash Out Your Home Value Fast.

Ad Give us a call to find out more. Home Equity Loan Consumer Disclosure English version to be used until Dec. Through the Federal National Mortgage Association Fannie Mae or FNMA there is a home equity and cash.

FNMA Texas Home Equity 50a6 and Non. Learn About PNC Banks Choice Home Equity Line of Credit. No Home Equity Loan.

Ad Apply Online For a Home Equity Loan. A Texas Section 50 a 6 loan must be secured by a single-unit principal residence constituting the borrowers homestead under Texas law. You may have the option to refinance your home.

Ad Give us a call to find out more. In 1997 Texas for the first time allowed homeowners to use the equity in their home as collateral for unrestricted cash borrowing. Variable Rates with Fixed Rate Options.

Ad Reviews Trusted by 45000000. Check Rates Apply Online Today. Over the past few months we have received a number.

If Your Homes Worth 150k You Can Tap Your Home Value. Home equity loans have important consumer protections. Your existing loan that you desire to refinance is a home equity loan.

Home Equity Loan Consumer Disclosure Spanish version to be used until Dec. With a Home Equity Line of Credit you can access up to 80 of the equity in your home at any time. There are significant limitations on this.

When you apply for a HELOC you may choose a monthly payment. Non-QM loans typically have interest rates that are on average 125 higher than QM loans. Ad Need to Borrow Against Your Home.

For example if you are repaying your home equity loan within five years and borrow 25000 and have an 80 CLTV you can expect. Home Equity Rates Low APR Top Lenders Comparison Free Online Offers. Certain types of foreclosures are.

These are just a few examples of the types of loan programs that Non-QM lenders may offer. These loans allow homeowners to use the equity in their home as collateral to refinance a prior debt and secure additional funds at rates that are typically lower than other. A lender may only foreclose a home equity loan based on a court order.

The refinance is not closed before the first anniversary of the date the home equity loan was. The pending legalization of home equity lending in Texas could be the biggest thing to happen to the mortgage industry since credit scoring experts say. Home equity loans in Texas and Houston TX area provided by TheTexasMortgagePros - the best Texas mortgage broker offering the lowest rate and fee for.

A home equity loan must be without recourse for personal. Mortgages without tax returns. Texas home equity loan has a different structure compared to home equity loan from other States.

Home equity loan as a non-home equity refinance loan under Article XVI subsection 50a4. Ad Use Lendstart Marketplace To Find The Best Option For You. A lender may only foreclose a home equity loan based on a court order.

Ad PNC Home Equity Lines of Credit. The Non-Home Equity program Texas 50 a 4 allows for a rate or term refinance of an existing Texas Home Equity loan. Get Free Quotes From USAs Best Lenders.

The length of your loan will also affect your interest rates. If you have applied to. Client Memo - Texas Home Equity Lending and Prohibited Additional Collateral Part One.

Non-Owner Borrowers September 22 2021. Voluntary Lien Texas Constitution. A home equity loan must be without recourse for personal liability against you and your spouse.

Non-home equity loan under secti on 50f2 article xvi texas constitution. Voluntary Lien Texas Constitution Article XVI Section 50a6A 7 TAC 1532 The equity loan must be secured by a voluntary lien on the homestead created under a written. Alternative income verification methods are accepted such as bank statements and asset.

These foreclosures are governed by Section 51002 of the Texas Property Code as well as the contractual documents. Compare Top Home Equity Loans and Save.

Pin On Our Home Loans Houston Online

7 Best Home Equity Loans Of 2021 Money

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

The Different Types Of Home Equity Loans Sofi

Personal Loans Vs Home Equity Loans Which Is Right For You Bankrate

Home Equity Loan On Inherited Property Inherited A House With No Mortgage

How Home Equity Borrowing In Texas Has Forever Changed

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Loans Pros And Cons Minimums And How To Qualify

How Does A Home Equity Loan Work In Texas

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Loans Home Loans U S Bank

Can I Get A Home Equity Loan On My Vacation Or Investment Property